No courses in the enrolment list.

When people consider making big changes in life like moving countries, changing careers, or enhancing tertiary education, understanding Australia’s living expenses becomes essential. Building a better future is harder than it sounds. You need to gain extensive knowledge about that country. Above all, the most important thing most people always pay attention to is Australia’s living cost. Which fees will you have to care about the most, which fees could you save at least, and how to cut down the cost of living in your life you will feel overwhelmed. This blog will delve into why it is crucial to your lifestyle in Australia.

Key Takeaways:

- You need some smart tips for stretching your dollar in Australia.

- With the average salary level in Australia, let’s see how much money you could pay in per year.

- Understanding which cities have the highest and the lowest living expenses is helpful for your life in Australia.

- Budgeting is essential for managing your living expenses effectively, especially as costs can vary significantly between Australian cities.

How Expensive Is Australia in 2026 – 2027?

Currently, there are numerous international students studying in Australia each year. Some would go by family’s financial support, some have scholarships, some by themselves.

The minimum official financial requirement for a student visa for one year (as of May 2024) is AU $29,710, which is approximately AU $2,475 per month. This requirement is set by the Australian government to ensure students have sufficient funds to support themselves. The non-accommodation portion of your budget, covering essentials like food, transportation, and utilities, would range from AU $800 to AU $1,500 per month, depending on your lifestyle and location.

Proper financial preparation is crucial before moving to Australia, as it helps ensure you can meet both the Australian government’s requirements and your actual living expenses. The question is that, whether with their grants and partly the escalating living cost of are enough for paying for stuff in Australia. Let’s break down the key elements that will help you understand in detail the living expenses.

Related articles :

- Cost of living in Melbourne

- Cost of living in Sydney

- Cost of living in Brisbane

- Cost of living in Adelaide

- Cost of living in Hobart

- Cost of living in Darwin

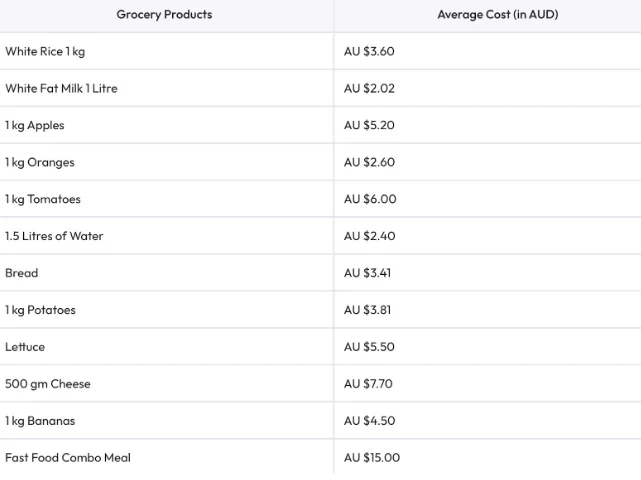

Grocery Costs in Australia.

Food and grocery costs are one of the bills that most students must pay every single day. Almost all Australians spent $14.69 billion at the supermarket in January 2025, according to data from the Australian Bureau of Statistics (ABS).

The total grocery bill for a student is around AU $300 – $600 per month or AU $70 – $150 per week. Here’s the price for some basic supplies and food items are as follow:

Although the climb in foodstuff is due to food inflation, these changes are also reflected in the consumer price index (CPI), which measures the overall rise in the cost of living. However, according to Australian Bureau of Statistics data, the rising in food and beverage prices are still escalating long-term averages.

For example, egg prices increased 11% last year, and the cost of cooking oil is up 7%; lamb prices have jumped 17%, while shoppers are paying about 6% more for fruit and vegetables. Beer prices have lifted by 4%.

In fact, the groceries will be cheaper in a rural area. For instance, bananas are 19.2% cheaper in Cairns than they are in Sydney.

To address this issue, students should cook their meals instead of going out to pricey restaurants at Aldi is the best way to protect your pocket.

Housing Rent Costs & Utilities in 2026

Housing rent costs:

Surely, to newcomers, your first priority should be to find accommodations. Besides, the cost of rent is one of the largest expenses for new immigrants, especially in major cities where the high cost of living can be a significant burden. If you feel challenged in finding accommodations or house matters, these are things you need to notice:

- Sydney consistently ranks as the most expensive city in Australia in terms of rent and overall living expenses, making it particularly costly for newcomers.

How much is the average rent in Australia?

This is vital information that you need to know while finding your housing. Later on, you need to find out how much is your budget and which location you will stay.

According to the most recent CoreLogic data, the median rent across Australia is currently $644 per week. In capital cities, it’s $675 per week, while the regional areas are over $100 cheaper at $559.

With the data above, it’s worth mentioning how to find the properties with the proper price. First, let’s look at the table below to have the bigger picture of dwelling types.

Depending on your needs, your monthly house bill would increase the household size.

The fact that your current situation could not buy a house in Australia. Hence, choosing shared apartments may be the right decision for you. PTE Magic suggests that you could access realestate.com.au, domain.com.au or flatmates.com.au. These websites may assist you in taking the stress out of any rent.

If you are considering which city should you base in Australia? The information below is essential for you.

- Absolutely, Sydney is always on the top list of renting or buying houses in Australia.

- Brisbane is now second-most expensive for houses.

- Perth recorded a slower price in September Adelaide and Hobart are worth considering at the most. Due to the rental price being in the mental price.

Also, you could think about renting dwellings in the suburbs. It could definitely be cheaper compared to living in the city area. Another tip is that researching public transport routes will help you decide where to look for long-term accommodation.

As everyone’s circumstances are different, it’s crucial to consider which dwelling type is the better choice for your circumstance.

Utilities costs:

After choosing your suitable accommodation, you need to factor in household costs, including the monthly cost of basic utilities such as electricity, gas, and water, when considering the cost of living in Australia. Here’s the monthly cost of each utility type; keep in mind that the cost below will change depending on the household size and the location.

According to the latest news of ABC News, electricity cost would increase to $6,223. The main root is due to the reliance on fossil fuels, aging infrastructure, network costs, and the slow transition to renewables. Increases in the cost of basic utilities like electricity and water contribute significantly to rises in living cost indexes across Australia, impacting overall affordability for households. Generally, the billing issue would be a worry without saving. Perhaps, you would encounter bill shock in the end of month.

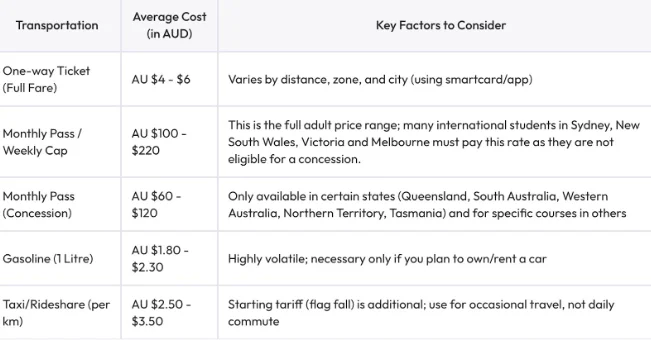

Transport Costs in Australia

City dwellers tend to move by bus, taxi or own car. As Australian cities were still designed for cars to be the quickest mode of transport, which was part of the reason public transport routes did not cover all corners of each city. However, it is quite expensive for newcomers to Australia.

Let’s see the analysis detail of transportation cost in the table below.

The kangaroo country has a well-developed public transport system. For this reason, Australia is in the top ten for most expensive transportation expenses in the world, according to the report Compare The Market. The report claims that one-way ticket average is about $4.59 AUD.

Public transport is another choice for getting around the city. It is fairly convenient and cheap to international students. But the drawback of this choice, the walking distance is pretty faraway to get public transportation. Additionally, they could use student identity cards for discount purposes.

When planning your monthly budget, it’s also important to consider occasional travel, such as trips outside the city or visits home, as these infrequent journeys can add to your overall transportation expenses.

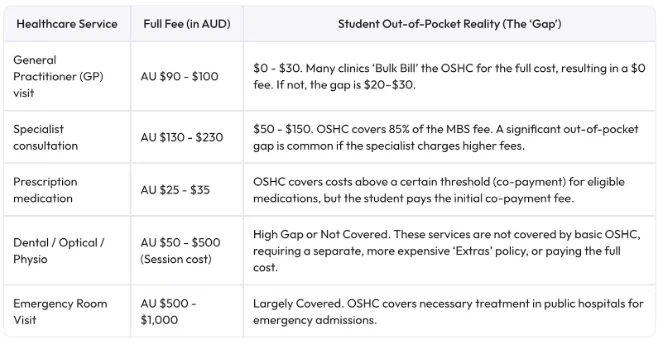

Healthcare Costs in Australia, Dentist Costs

Healthcare Costs

Healthcare is another important aspect of living in Australia. As an overseas student, obtaining health insurance (Overseas Student Health Cover – OSHC) is a must. The cost of health insurance can range from $400 AUD to $800 AUD annually. To OSHC range from $600 AUD to $1,000 AUD. This investment ensures you are protected in case of emergency, which is truly essential when living abroad. Absolutely, you can get treatment at public hospitals but without health insurance, bills can be huge.

Plus, you can get an Australian student visa and similar ones require you to enter the country with insurance.

Moreover, OCHC is mentioned above, you could access https://www.privatehealth.gov.au/ to find out which insurance types fit you.

Dentist Costs

This service is not covered by basic OSHC and requires paying the full cost. The full fee ranges from AU $50 – $500 (session cost).

Education & Childcare Costs

The next expense, which absolutely could not lack in this list, is exactly education. Australia has long been considered the top reason that almost all people come to gain higher education due to the high quality of the education system. Australian universities are especially important for international students, as choosing the right institution and understanding the application process can greatly impact their study experience.

When living in an affluent country like Australia, financial matters may be a major concern for almost all students. International students could find it difficult to pay for high living costs without frequent support from family. To cope with paying tuition fees, some students have to study and work at the same time but it is challenging for them to balance job and learning.

For the purpose of getting a Bachelor’s Degree, the annual cost of education in Australia can range from approximately AUD $20,000 to $50,000. Similarly, the cost of studying abroad in Australia for a Postgraduate Degree typically falls within the AUD $22,000 to $54,000 bracket per year.

Let’s look at the table below for more details.

Depending on the major you choose, the cost would change depending on your major. Furthermore, some additional costs at university, such as course materials, clothing, safety equipment, study materials and textbooks, OSHC and Student Services and Administrative Fees, considerably contribute to their rising costs. So, let’s search for these additional university costs.

Student services and administrative fees:

On top of your tuition fees, you’ll most likely encounter student services and administrative fees in Australia. These generally range from about AUD $300 to $1,000 per year, but the exact amount depends on the specific university you’re attending. These fees contribute to a range of essential services and resources which includes funding for student clubs and activities, designed to enhance your overall student experience.

Health Insurance (OSHC):

As mentioned above, OSHC truly helps you cover health expenses. It can cost between $600 AUD to $700 AUD per year. Hence, do not forget to factor this indispensable health insurance into your cost of studying abroad.

Study materials and textbooks:

Another element that is worth mentioning is the cost of study materials and textbooks. Depending on your study program and study level, you can expect to budget around $500 to $1,000 AUD per year for these.

Internet & Mobile Plans

In terms of Internet costs and mobile phone plans. It spends around Internet (Wi-Fi) $50 – $80 AUD and Mobile Phone Plan (Unlimited Talk/Text, Data) $25 – $50 AUD.

Insurance (health extras, contents, car)

Additionally, there are some out-of-pocket costs that you unplanned costs of living in Australia. Changes in interest rates, set by the Reserve Bank of Australia, can directly affect household expenses, especially for those with home loans, as fluctuations in mortgage interest charges may increase or decrease your overall living costs.

- Healthcare Service Costs

- Car insurance: there are three main types of car insurance in Australia namely:

CTP Insurance: protecting drivers from the financial impact of causing injury or death in a motor vehicle accident anywhere in Australia. Motor injury insurance premiums for motor cars are $491.40 AUD for a 12-month period. This includes GST and insurance duty.

Third-Party Property Insurance: is an option and provides cover if you’re liable for loss or damage your vehicle causes to another person’s vehicle or property.

| Uninsured driver protection | Driver with confidence | Included events |

|---|---|---|

| Up to $5000 AUD cover for your car, if not your fault, and the other driver is insured. | Covers your legal liability for damage to other people’s property up to $20 million. | Cover damage to other people’s property up to $20 million. Up to $5000 AUD cover for your car, if not your fault, and the other driver is insured. |

Comprehensive Insurance: Unlike CTP insurance, CTPcan provide cover for damage to your car, as well as damage to other people’s cars and property after an insured incident. The average cost of comprehensive car insurance in Australia ranges from about $1,750 AUD to more than $2,700 AUD, according to Canstar Research.

Eating Out, Entertainment & Personal Care

Lastly, due to the vibrant environment of Australia it could attract you with multiple choices, namely, tasty food, movies, musical events and festivals, etc. According to Aeccglobal, Aussie costs amount to about $150 – $400 AUD for shopping and entertainment.

Here’s an overview the monthly expenses as regards leisure activities:

The research is clear that the leisure and entertainment cost of living in Australia are somewhat higher.

Typical Monthly Budgets by Persona

The cost of living varies depending on some factors, such as your lifestyle, choice of accommodation, and family size. The key expenses you’ll need to factor into your calculations should include:

- Housing: The biggest expense for most residents.

- Utilities: Electricity, gas, Wi-Fi, and water bills.

- Transport: Public transport fares, fuel costs, and car expenses.

- Food and Groceries: Weekly supermarket shopping and dining out.

- Healthcare: Medical check-ups, insurance, and specialist visits.

- Childcare and Education: School fees, daycare, and after-school care.

- Entertainment and Recreation: Gym memberships, movies, and social events.

To get a more accurate estimate and plan your monthly budget, consider using a living calculator. This online tool provides broad estimates of potential living expenses in Australia, helping you prepare financially and understand how costs can vary by location.

International Student (shared housing)

Many students face financial burden because they:

- Overspend in the first few months before adjusting to local prices.

- Rely entirely on part-time jobs without a financial cushion.

- Ignorance hidden costs like transport, medical expenses, or utilities.

This is Monthly Budget Planning Sample for International Students

Single Working Professional

Here’s a typical breakdown:

- Accommodation (1-bedroom apartment) (Suburban Area) : $1,680 AUD

- Accommodation (1-bedroom apartment in the city centre): costs around $2,160 AUD

- Utilities & Internet: $427 AUD

- Food: $550 AUD – $700 AUD

- Transportation: $143 AUD

- Entertainment: $150 AUD – $200 AUD

Single person estimated monthly costs (without rent): $1,647.60 AUD

Couple (no kids)

Here’s a typical breakdown:

- Accommodation ( City Centre): $2,000 AUD – $3,200 AUD

- Accommodation (Suburban Areas): $1,200 AUD – 1,800 AUD

- Utilities & Internet: $180 AUD – $250 AUD/month

- Food & groceries: $700 AUD – $900 AUD

- Transportation: $200 AUD – $400 AUD

- Entertainment: $400 AUD – $800 AUD

Couple (no kids) estimated monthly costs (without rent) from $4200 – $4500 AUD

Family of Four

For a family of four, the cost of living in Sydney can climb even higher due to larger accommodation needs, schooling, and daily household expenses. The main contributors to these high costs are rent, childcare, and education, which significantly impact the overall budget for families. The monthly average ranges between $6,500 AUD and $7,000 AUD particularly if the family is renting a 2–3 bedroom apartment or house near the city.

Here’s a typical breakdown:

- Rent (3-bedroom in city or closer suburbs): $4,000 AUD – $4,500 AUD

- Utilities & Internet: $400 AUD – $500 AUD

- Groceries: $1,200 AUD – $1,500 AUD

- Transportation: $300 AUD – $400 AUD

- Childcare/Education/Other: $600 AUD – $800 AUD

- Entertainment: $600 AUD – $1.200 AUD

Family of four estimated monthly costs (without rent): $5,828.60 AUD

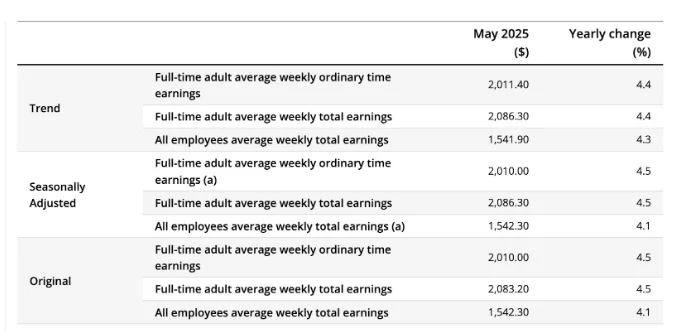

What’s the Average Salary in Australia? (median vs mean, after-tax estimates)

Being the largest country in Oceania, it is among the favoured nations for internationals to live. Aside from the largest economy, breathtaking landscapes, high living standards, and a higher average salary in Australia for full-time and half-time work hours compared to internationally.

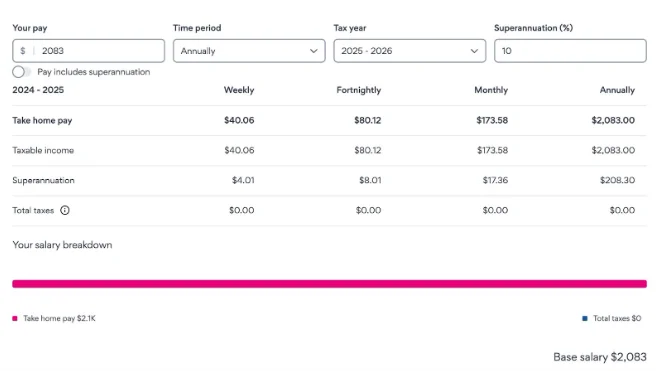

In August 2025, the Australian Bureau of Statistics released their average weekly earnings data. The headline for full-time adult average weekly total earnings is $2,083AUD. This data is supposed to increase by 4.5% annually to $2,010 AUD in 2026. While employee earnings

The average salary in Australia is approximately $100,000 annually. If you are at the age of between 25 and 34 and earn $100,000 AUD/ year. You’re earning more than 79% of Australians at your age.

However, households whose principal income comes from government payments may face different affordability challenges, especially as changes in government transfers and rebates can significantly impact their ability to cover essential expenses like electricity and housing.

The above mentioned, it is clear that your personal income will be beneficial as living and working in Australia compared to other countries.

Take-Home Pay Basics

Take-Home Pay is the part of your gross wage that’s left after taxes and other deductions have been taken out. If you know your wage, you can use a pay calculator to estimate how much you will take home each pay cycle.

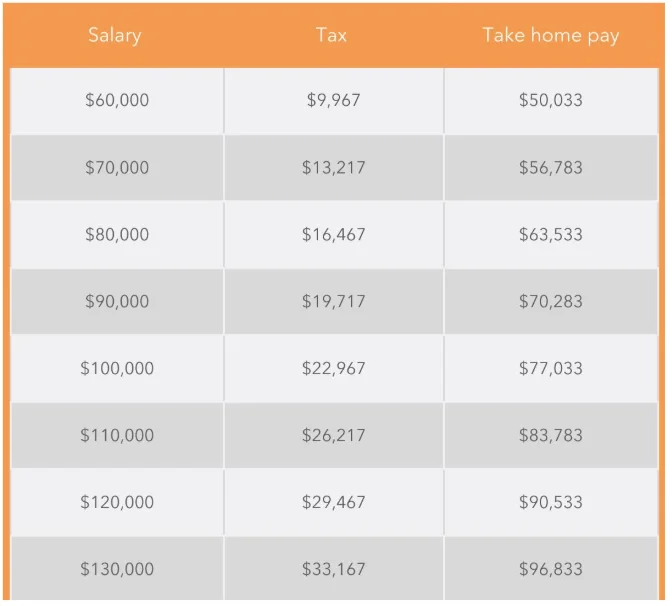

Below is a simple table highlighting the take-home pay for salaries ranging from $60,000 AUD to $130,000 AUD

It’s important to weigh all the variables when considering a job offer, including the ones we often overlook, like tax.

Now, let’s see how much you’ll be paid weekly, fortnightly or monthly by the data below.

Cost of living by city

Understanding the Average Cost of Living Per Month in Australia is essential for living in Australia. The Australian cost of living by city can differ drastically, and costs also vary significantly by state. For example, South Australia is known for its relatively lower median weekly earnings, but public school voluntary contributions there are higher compared to other regions. Additionally, New South Wales (also referred to as South Wales) has the most expensive private secondary schools, with an average annual tuition fee of $13,896, which is higher than in other states like Victoria. Therefore, it’s important to take all these factors into consideration when deciding where to move to optimize living expenses.

Let’s break down with PTE Magic about the average monthly expenses for a single person living in Australia.

Here are the top 7 cities with the most crowded population in the Kangaroo country.

Sydney

The living cost in Sydney is well-known to be among the highest in Australia. As the country’s largest and most vigorous metropolis, Sydney boasts a growing economy, global career opportunities, and great educational institutions. Therefore, the highest expense for most of the residents in Sydney is renting.

Let’s take a loot at the average monthly expenses for a single person living in Sydney:

Monthly Expenses (Single Person):

| Expense Category | Average monthly cost |

|---|---|

| Rent (1-bedroom in city) | $2,500 AUD |

| Utilities & Internet | $250 AUD |

| Food & Groceries | $600 AUD |

| Transportation | $200 AUD |

Melbourne

As the capital of Victoria, Melbourne is a popular destination for students, skilled migrants, and families. The living cost in Melbourne is slightly more affordable than in Sydney.

Monthly Expenses (Single Person):

| Expense Category | Average monthly cost |

| Rent (1-bedroom in city) | $2,200 AUD |

| Utilities & Internet | $220 AUD |

| Food & Groceries: | $550 AUD |

| Transportation (public) | $180 AUD |

Brisbane

Brisbane is the capital of Queensland and growing fast and offers a balanced lifestyle with relatively lower costs. Also, Melbourne has been consistently ranked as one of the world’s most liveable cities. The average cost of living in Brisbane Australia is ideal for students and families alike.

Monthly Expenses (Single Person):

| Expense Category | Average monthly cost |

|---|---|

| Rent (1-bedroom in city) | $1,800 AUD |

| Utilities & Internet | $200 AUD |

| Food & Groceries | $500 AUD |

| Transportation | $170 AUD |

Adelaide

The Adelaide cost of living is ideal for international students who are looking to stretch their dollar.

Monthly Expenses (Single Person):

| Expense Category | Average monthly cost |

|---|---|

| Rent (1-bedroom in city) | $1,500 AUD |

| Utilities & Internet | $190 AUD |

| Food & Groceries | $470 AUD |

| Transportation | $160 AUD |

Perth

Located in Western Australia, Perth is famous for its stunning beaches and mining industry. The cost of living in Perth is moderate but can vary depending on how you spend your life in this city.

Monthly Expenses (Single Person):

| Expense Category | Average monthly cost |

|---|---|

| Rent (1-bedroom in city) | $1,900 AUD |

| Utilities & Internet | $210 AUD |

| Food & Groceries | $500 AUD |

| Transportation | $180 AUD |

Hobart

Hobert offers a unique blend of beauty and affordability, located on the island of Tasmania. The cost of living in Hobart is lower than in other major Australian cities.

Monthly Expenses (Single Person):

| Expense Category | Average monthly cost |

|---|---|

| Rent (1-bedroom in city) | $1,474 AUD |

| Utilities & Internet | $300 AUD |

| Food & Groceries | $449.53 AUD |

| Transportation | $112 AUD |

Darwin

Darwin, a city with a rich diversity of culture mixed with stunning landscapes. Darwin’s small population and vast freight distances mean the cost of living is comparatively inexpensive.

Monthly Expenses (Single Person):

| Expense Category | Average monthly cost |

|---|---|

| Rent (1-bedroom in city) | $1,700 AUD |

| Utilities & Internet | $350 AUD |

| Food & Groceries | $380.91 AUD |

| Transportation | $90 AUD |

Regional Towns Snapshot

| Cities | Comparison Base | Different Cost of Living | Cheaper/ More expensive |

| Melbourne | Sydney |

|

More expensive |

| Adelaide | Sydney |

|

Cheaper |

| Darwin | Melbourne |

|

Cheaper |

| Perth | Sydney |

|

Cheaper |

| Darwin | Sydney |

|

Cheaper |

Affordable Cities and Lifestyle

The cost of living in Australia can vary dramatically depending on which city or region you choose to call home. For students, families, and individuals alike, understanding these differences is key to making smart decisions about where to live, study, or work. While living in Australia’s major cities like Sydney and Melbourne often comes with a higher price tag, there are plenty of other cities and regional areas that offer a more affordable lifestyle without sacrificing access to quality education, career opportunities, or vibrant communities. By comparing living costs across different cities, you can find a location that matches both your budget and your lifestyle goals.

Cheapest cities for students and families

If you’re looking to keep your living expenses in check, cities like Adelaide, Perth, and Brisbane consistently rank among the most affordable in Australia. These cities offer a lower cost of living compared to the larger metropolitan hubs, making them especially attractive for students and families who want to save money while still enjoying a high standard of living. For example, the average rent for a one-bedroom apartment in Adelaide is much lower than in Sydney or Melbourne, freeing up more of your budget for other essentials or leisure activities. In addition to affordable housing, these cities provide excellent education options, diverse career opportunities, and a relaxed lifestyle, making them ideal choices for those seeking value without compromise.

How lifestyle choices impact your budget

Your day-to-day decisions can have a big impact on your monthly expenses and overall living costs in Australia. Accommodation arrangements are a major factor—opting for a shared house instead of renting a private apartment can significantly reduce your housing costs. Transportation options also matter; using public transport rather than owning a car can help you save on fuel, maintenance, and parking fees. Leisure activities, such as dining out or attending events, can quickly add up, so being mindful of how often you indulge can help keep your budget on track. For international students, understanding how these lifestyle choices affect living expenses is especially important, as it allows for better financial planning and helps avoid unnecessary financial stress while living and studying in Australia.

Balancing affordability and quality of life

Finding the right balance between affordability and quality of life is essential when living in Australia. While choosing a city or region with lower living costs can help you save money, it’s also important to consider what you might be giving up in terms of amenities, career opportunities, or social activities. Living in a major city may mean higher living expenses, but it often comes with greater access to jobs, cultural events, and a dynamic lifestyle. On the other hand, regional areas and smaller cities can offer a more relaxed pace and lower costs, but may have fewer options for work or entertainment. By carefully weighing your priorities—whether it’s career growth, lifestyle, or saving money—you can make informed decisions that allow you to live comfortably and happily in Australia.

Salary vs Expenses: Affordability Calculator

As of 2025, the average income in Australia is approximately $1,542,30 AUD per year. The income needed to live comfortably in Australia varies based on the city and lifestyle:

- International Student: An income of around $25,000 AUD to $35,000 AUD per year is usually sufficient to live comfortably as a student.

- Bachelor: A single person typically needs an annual income of $50,000 AUD to $70,000AUD to live comfortably in major cities like Sydney and Melbourne.

- Couple: A couple generally needs a combined income of around $80,000 AUD to $120,000 AUD per year to cover accommodation, food, transportation, and entertainment.

- Families: An annual income of $120,000 AUD to $180,000 AUD is usually required to cover all expenses for a family of four.

Money-Saving Tips for Australia

The most efficient method to save money is by means of smart planning. By using These tips below for utilizing costs:

Tip 1: Priortize Your Location

- Choose Affordable Cities: Rent is the highest cost. Cities like Adelaide, Perth, and Brisbane, or regional areas, are significantly cheaper than Sydney and Melbourne.

- Shared Accommodation: Always choose to live in a shared house/apartment with flatmates to split the rent and utilities (this can save over AU $1,000 per month compared to a private apartment).

Tip 2: Control Food Costs

- Prepare meals at home: This is the single biggest saver when trying to reduce your cost of living in Australia. Budget to spend roughly AU $300–$600 per month on groceries.

- Avoid Takeaway: Limit eating out, as a single casual restaurant meal can cost $20–$30 AUD.

Tip 3: Optimize Student Discounts & Transport

- Get a Student ID/Pass: Using your student card to claim discounts (10–20%) at museums, cinemas, retailers, and restaurants would lessen your overall cost of living in Australia.

- Master Public Transport: Utilise buses, trains, and trams. In states that offer it (e.g., QLD, SA, WA), apply for the student concession card to halve your travel costs.

- Walk or Cycle: For short-distance commutes, a bike is the low-cost option after the initial purchase.

Tip 4: Earn and Budget Strategically

- Find Part-Time Work: Your Australian student visa allows you to work up to 48 hours per fortnight during the academic term (and full-time during breaks) to supplement your living cost.

- Seek Financial Aid: Apply for both university and government scholarships, grants, and bursaries before and after arrival.

Tip 5: Be Wise with Money & Utilities

- Use Low-Fee Banking/Transfer: Open a local Australian student bank account to avoid monthly fees, and use money transfer services (instead of traditional bank wires) to cut back on international exchange fees.

- Manage Utilities: Be conscious of electricity/gas use, especially with heating and cooling, as these can add hundreds of dollars to your monthly bill if not managed.

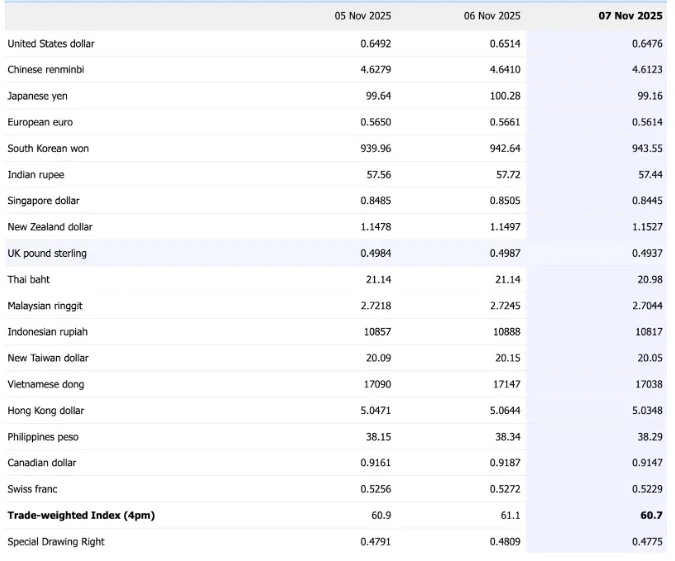

Exchange Rate Used & Price Update Cadence

The Reserve Bank of Australia (RBA) calculates and publishes the Trade Weighted Index (TWI). The RBA annually recalculates the weights of the TWI based on the composition of Australia’s merchandise goods and services trade for the previous fiscal year. Currencies that are removed from the TWI will no longer have their exchange rate data published in our statistical tables. These data should not be relied upon for any regulatory or commercial purposes.

Exchange Rate Used

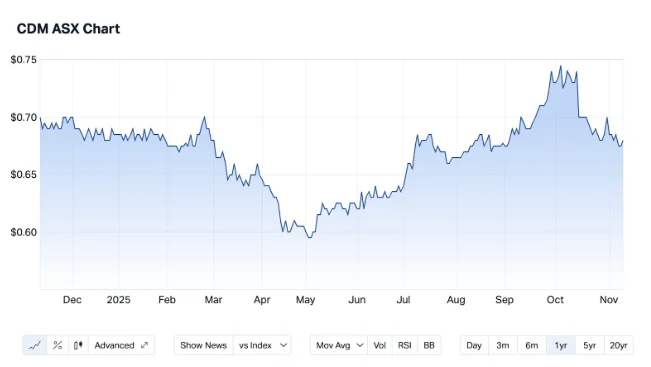

Price update cadence:

The price update candance for the ASX (Australian Securities Exchange) is typically updated every 20 minutes for stocks like Cadence Opportunities Fund Ltd (CDO). Real time prices are also available, with financial websites like Market Index offering live-streaming updates.

Frequently Asked Questions.

Is Australia more expensive than the UK/US/NZ in 2026 ?

Australia is generally 10-25% more expensive than the UK for everyday living expenses.

On average, the living cost of the United States is higher than the cost of living in Australia. According to the World Population Review, Australia is only the tenth most expensive country to live in.

The cost of living in New Zealand is lower than in Australia. However, salaries are higher in Australia, making it manageable for migrants.

What is a good salary to live comfortably in Sydney/Melbourne?

The average salary in Australia is about $98,000 per year and the median salary around $65,000.

- Sydney : According to ABS 2025 estimates, the average full-time salary in Sydney is approximately $84,600 AUD.

- Melbourne : According to Salary Expert, the average salary for jobs in Melbourne, Australia is $89,135 AUD per year.

Are healthcare and dentist visits covered or out-of-pocket?

Though OSHC provides cover, international students would encounter an ‘out-of-pocket gap’ where the doctor’s fee is higher than the amount set by the government.

How much is rent for a room vs a one-bedroom?

Typically $1,400–1,800 AUD per month for a single room in a shared apartment or house, depending on location and amenities.

Do prices vary a lot between suburbs?

Yes, the data showed that even in pricey regions of the capitals, buyers could still find suburbs where homes were typically much more affordable than the region overall.

Meanwhile, eastern suburbs unit buyers stood to save most by searching in Edgecliff, where a typical unit cost $343,000 less than the region’s median unit value of $1.21 million.

How often do costs change with inflation?

Inflation occurs when prices rise, eroding the purchasing power of money. Economists identify three primary causes— cost-push, demand-pull, and built-in inflation—each stemming from different pressures. Recent inflationary surges were driven by supply chain disruptions and rising energy and food prices. Excessive money supply can also intensify inflationary pressures.

Is it cheaper when ordering groceries online instead of shopping for groceries in a store?

The answer is absolutely true. You’ll save money and time by not using petrol to drive to a supermarket or take public transport. Besides, you can often find the latest deals in one section of the website, rather than roaming around the store.

What are some tips to reduce living costs while studying in Australia?

Let’s be smart with your finances, cooking at home, utilizing public transport alternatives like biking or car, maximize student discounts (saving about 10 – 20%), and seeking affordable accommodation options like Brisbane and Adelaide.

Can working part-time help manage the cost of living in Australia?

Of course, the Australian student visa allows a work limit of 48 hours per fortnight when the academic session is on and unlimited hours when scheduled course breaks/holidays. On July 1st, 2025, the minimum wage for all national and Australian students is AU $24.94 per hour.

Conclusion

In summary, we hope the information is helpful for those who intend to move to Australia to settle down in Australia. Each individual has their own purpose for living in Australia. Then, by understanding the Australia cost of living by city, you can make smarter financial decisions whether you’re a student, professional, or planning a family move.

Check out other PTE Magic blogs for more detailed information on studying and living in Australia. Cheers!

Last updated on 26/12/2025

My name is Moni, and I am a seasoned PTE teacher with over 6 years of experience. I have helped thousands of students overcome their struggles and achieve their desired scores. My passion for teaching and dedication to my student’s success drives me to continually improve my teaching methods and provide the best possible support. Join me on this journey toward PTE success!

I am a firm believer that the best teachers educate with their hearts not just their minds.

Moni | PTE MAGIC International Founder

Explore PTE

Tips & Tricks

In this 2026 guide, you’ll see a complete breakdown of real living expenses, part-time job...

Read more →The cost of living in Hobart among international students is among the most important aspects...

Read more →Why Adelaide Is One Of Australia’s Most Budget-Friendly Cities Adelaide is also unique in its...

Read more →