No courses in the enrolment list.

The Best Bank Accounts For International Students In Australia: Trusted & Affordable (Updated 2026)

by Moni Vuong

Before you travel to Australia for international students to start your studies, there are a few things you must complete as an international student. Opening a local bank account is part of this. It takes diligent examination and determination to find the best bank accounts for international students in Australia. Fortunately, we have compiled the top choices to make your research a little quicker.

Key Takeaways

- The article covers the best banks for international students in Australia, highlighting top options and their benefits.

- There are 4 major banks in Australia that offer specific accounts tailored to international students.

- You can open a bank account online and before your arrival but need to verify it at a bank branch after you get there with some documents.

- International students’ accounts are protected and covered under the FCS

- You can switch accounts or close it in a very comfortable way.

Introduction to Banking in Australia

Banking in Australia is an essential part of settling in and managing your finances as an international student. Understanding how the Australian banking system works will help you make the most of your money while studying abroad. There are several types of bank accounts in Australia, but the two most important for international students are transaction accounts and savings accounts. Transaction accounts are designed for everyday use, allowing you to pay bills, receive money, and manage daily expenses, while savings accounts help you set aside funds and earn interest.

Australia’s four major banks—Commonwealth Bank, Westpac, National Australia Bank, and ANZ—are well-known for offering student bank accounts with features tailored to the needs of international students. These banks provide a range of banking services, including online and mobile banking, debit cards, and easy ways to pay tuition fees and handle everyday transactions. When choosing a bank account in Australia, it’s important to compare monthly account fees, international transaction fees, and the types of debit cards available. A student bank account is not only convenient for managing your finances but is often required for receiving scholarships, part-time job payments, and transferring money from home. By understanding your options and the services offered by major banks in Australia, you can choose the best bank account to support your studies and financial wellbeing.

Reasons for International Students to Open a Local Bank Account

There are many banks that offer accounts to foreign students, so opening a local bank account is a no-brainer. Whichever option you choose, you can enjoy the benefits that each of them bring for your study and life:

- Avoid poor foreign exchange rate and excessive transaction costs

- Simpler and less expensive payments for things like rent, phone and other utilities

- More effective salary and scholarships management as many universities demand a local account in order to deposit salaries or financial aid directly

- Access to various local banking services

Opening a local bank account is also an important step in building a strong financial future, helping international students establish a secure foundation for long-term financial stability and success.

What are The Best Bank Accounts for International Students in Australia?

You can find many options for opening a bank account. This article compares the top student banks and student banking options from Australia’s leading financial institutions, helping you choose the best fit for your needs as an international student. Most Australian banks, including the student banks listed below, offer convenient online account opening and student options online, making it easy to get started before you arrive. These banks have branches in major Australian cities, ensuring accessibility and support wherever you study.

Yet, for international students in Australia, we recommend these 4 following major banks. They offer special and unique deals and benefits for students coming from all over the world to study in Australia.

| Commonwealth Bank (CommBank) | Westpac Bank | Australia and New Zealand Bank (ANZ) | National Bank of Australia (NAB) | |

|---|---|---|---|---|

| Account name | Everyday Smart Access Account (offered by Australia’s largest retail bank) | Student Choice Bank Account | Student Access Advantage Account | Classic Bank Account |

| Monthly fee | ❌ | ❌ | ❌ | ❌ |

| International transfer fee/FX | 3% | 3% | 3% | 3% |

| ATM network | 1,819 ATMs in Australia | 778 ATMs in Australia | 869 ATMs in Australia | 719 ATMs in Australia |

| Open before arrival? | ✅ | ✅ | ✅ | ✅ |

| ID needed? | ✅ | ✅ | ✅ | ✅ |

| App rating (App Store) | 4.7/5 | 4.5/5 | 4.7/5 | 4.8/5 |

Commonwealth Bank – Everyday Smart Access account

The largest retail bank in Australia, Commonwealth Bank provides a variety of services and products to its clients. It was awarded “Bank of the Year – Digital Banking” for 2025 (for the 16th year in a row) by Canstar in May 2025.

To assist international students with daily financial tasks, it provides the Everyday Smart Access Account. This account can be opened by international students up to 14 days before their arrival in Australia or those who have arrived there in the past 12 months. When you open the account online, you receive your bank details straight after completing the application, making it easy to set up payments or share your account information quickly.

Within 20 days of creating this account, you must present your ID (Passport) for verification in one of its branches. Otherwise, you won’t be able to deposit funds or make account transactions, resulting in your account being closed immediately.

This account as a number of features, such as:

- No monthly fees if you are under 30

- Transferring money worldwide with the foreign exchange fee sitting at 3%

- Vast ATM and branch network throughout Australia

- Access to the CommBank App for features like expense monitoring, cardless transactions, etc.

- Earn interest on your savings with NetBank Saver, a flexible online savings account connected to your Everyday Smart Access account

- Cashback from well-known brands thanks to CommBank Rewards for shopping and activation

Why we like it:

- Unlimited free transactions from ATMs, EFTPOS, counter deposits, phones and transactions

- Lots of special students discounts and affordable deals

- No account keeping fee for the first 12 months when applying through the CommBank website

- Syncing your card with your device for quick, simple and safe online, in-store and app payments.

Best for: International students who want to save money and earn interest on their part-time work income.

Westpac Bank – Choice account

Westpac student bank is a well-known bank for international students thanks to its specialized services and assistance in all major cities across Australia.

International students can open the Westpac Choice Student Account to enjoy special deals tailored for them. You can create this account up to 3 months before traveling or after arriving in Australia. Yet, you still need to visit its branch to activate the account.

This account has a number of features, such as:

- No monthly fees if you are a full-time student or under 30

- There is a 3% foreign exchange fee if you transfer money globally and a $5 ATM fee when withdrawing money from an ATM outside Australia

- No direct ATM fees for withdrawals at partner ATMs in Australia, with access to over 50,000 ATMs worldwide thanks to the Global ATM Alliance and partner ATMs (as long as the ATM is located in Australia)

- Access to mobile app features and internet banking, including integrating your account with your device for online and in-store payments, managing your finances on the go, etc.

- Instant card lock and fraud protection features

Why we like it:

- No account keeping fee for the first 12 months

- Great banking packages with special deals for international students

- Easy-to-use mobile and internet banking services

- Assistance with setting up an Australian Tax File Number (TFN)

- Enabling international money transfers

Best for: International students with high frequency of payments for daily activities.

ANZ Bank – Student Access Advantage account

As one of Australia’s top financial institutions, ANZ has banks in many cities and regions in the country. Moreover, overseas students can deposit foreign currency straight into their ANZ Student Access Advantage account and exchange it for Australian dollars at any ANZ location thanks to the bank’s own ANZ Foreign Exchange Service.

Importantly, ANZ offers you the ANZ Student Access Advantage account which you can apply for prior to your arrival in Australia. You can activate your account at one of its branches with your valid student ID after you get there.

Students can also open an ANZ Progress Saver account alongside their main account to help manage savings. The ANZ Progress Saver account is a savings tool linked to the student account, offering bonus interest when you deposit at least $10 and make no withdrawals each month, with no monthly fee.

This account has a number of features, such as:

- No monthly fees

- There is a $5 ATM fee and a 3% foreign exchange commission for international withdrawal or transfers

- Receiving bonus interest if you deposit at least $10 into your account and don’t take out money each month (relevant T’s & C’s apply)

- The goMoney mobile app gives you an user-friendly online banking for better convenience

Why we like it:

- Easy banking options with no account fees

- No account keeping fees for the first 12 months

- Easily converting foreign cash into Australian dollars thanks to its ANZ Foreign Exchange Service

- Unlimited transactions, no threshold balance and no withdrawal fees

- Benefits and discounts for students on certain services and products

Best for: International students who want to exchange foreign currency into Australian Dollars at a reasonable rate and quickly.

National Bank of Australia – Classic Banking account

National Australia Bank (NAB), one of Australia’s biggest banks, has branches across major cities in the country. Besides, it has partnerships with small to large businesses to offer various services for their clients.

Up to 12 months prior to your arrival in Australia, you can apply for its Classic Banking account with your valid student visa. You can open it online via Moving to Australia on their website.

This account has a number of features, such as:

- No monthly fees

- Over 700 ATMs in Australia without withdrawal fees

- There is a $5 cost for international ATM withdrawals and a 3% foreign exchange fee associated with the NAB student account

- Access to a wide range of online and mobile banking features via the app

- Tools and resources for financial management education

- Comes with a debit Mastercard linked to your account for secure online and in-store transactions

Why we like it:

- Student bank account with no monthly fees, no minimum monthly deposits and now overdrawn fees if your account balance is exceeded

- You can make a deposit before your arrival in Australia

- Special savings and benefits for international students

- Easy payments for in-store and online purchases or other expenses.

Best for: International students want a bank account with no hidden fees (overdrawn fees)

Other Alternatives

There are other banks that have a sizeable clientele and a wide range of services you can look at. Although they don’t have a specific account tailored to international students, their accounts still offer a lot of benefits that you can enjoy. When opening accounts with these alternative banks, you can use a bank statement as proof of identity or residency for official purposes.

- St. George Bank: Its Complete Freedom account is made for day-to-day banking needs. It has no monthly or keeping fees and offers many services and cashback deals.

- Citibank: Its Citibank Plus Account has no monthly, transaction or fund transfer fees. The services and products range from the mobile app to free ATM withdrawals within the Citi ATM network in Australia.

- Suncorp Bank: Its Everyday Options Account has no monthly account keeping fees and offers high rates for your savings.

Overall, this is just a brief overview of a few Australian banks. When you get there, you will see that there are more local banks in your area that you could try.

Everyday Account Features

Everyday accounts are designed to make banking simple and accessible for international students living in Australia. These accounts typically come with unlimited free transactions, so you can pay bills, shop, and withdraw cash without worrying about extra charges. Most banks in Australia, including the major banks, offer online banking and mobile banking services, making it easy to manage your money on the go.

The Everyday Account Smart Access from Commonwealth Bank is a popular choice, providing a debit Mastercard for secure everyday transactions and the convenience of contactless payments. Similarly, the NAB Classic Banking account stands out for having no monthly account service fee and offering a debit card that can be used across Australia and internationally. Many everyday accounts also allow you to deposit foreign currency directly, which is especially useful for international students who need to transfer money from overseas.

Other features to look for include access to a global ATM alliance, which can help you avoid overseas ATM fees when withdrawing cash abroad, and the ability to manage your account online or through a mobile app. With these features, international students can enjoy flexible, low-cost banking services that fit their busy lifestyles and help them stay on top of their finances while studying in Australia.

Factors to Consider When Looking for a Student Bank Account

As you can see, every bank offers basic tools for common activities and unique features tailored to special needs. In general, when looking for a local bank account as an international student, keep in mind the following aspects:

- No monthly account fee or hidden fees

- No ATM withdrawal fees at a large network of ATMs

- No transaction fees on domestic transfers or ATM withdrawals

- Transferring money worldwide at a good exchange rate

- Offering mobile apps to facilitate your online and mobile banking

- Allowing you to open an account before you arrive

- Availability of special deals and benefits for students

- Offering options for savings and financial management

A transaction account is the most suitable type of account for daily banking needs, as it allows you to manage deposits, withdrawals, and card payments easily.

These are common yet important features that a good bank account for international students should have. If you have any special personal needs, you can add them to this checklist to find the most suitable one.

The Complete Guide to Create a Student Account

Creating a bank account as an international student is easy as you can do it online before your arrival in Australia. Many banks provide student options online, allowing for quick and easy account setup tailored to students. Yet, you can not withdraw or transfer money after you prove your identity. Thus, be prepared with the required paperwork.

Each bank may require different documents and have different procedures but the following guide illustrates the most common steps in this section. After your account is approved, you will receive your bank details, such as your account number and login information, so you can start using your account right away.

The Required Documents

A valid student visa, evidence of identity, proof of address and your tax residency status are some of the documents you need to activate your account.

- Student Visa: Most of the time, you will be required to present documentation of your upcoming travel to Australia, such as arrival dates and a copy of your student visa application.

- Identity Verification: Australia verifies identity documents using a weighted points system called the Australian ID points system. The value of each document varies and for ID Verification, you must achieve 100 points to open a bank account. The ID documents include a mix of primary and secondary paper. A legitimate translated copy must be added if your documents are not in English.

- Proof of Address: An Australian residential address is typically required, such as a rental agreement or the address where your card should be delivered. However, some banks may allow you to set up your account initially without an Australian residential address, especially if you are an international student.

- Tax Residency: Though you are able to apply from the outside of the country, you still need to provide your tax number, which can be from your home country, as well as your tax residency status.

The Procedure to Create A Student Account

Most banks allow you to open an account online but require you to verify it later at one of its branches after you arrive in Australia. Generally speaking, the procedure will entail:

- Completing the application online

- Submitting required documents at the branch

- Verifying that all of your information is true and correct

- Make a minimum deposit if your selected bank requires

- The bank will approve your account and send you the details

Safety & Guarantees: Deposit Protection & Bank Coverage

The Australian government’s Financial Claims Scheme (FCS) offers financial security to depositors of Australian-incorporated authorized deposit-taking institutions (ADIs) like banks. You can search the List of authorised deposit-taking institutions covered under the Financial Claims Scheme to see if your bank is one of them.

Only deposit accounts with balances in Australian dollars are covered by the FCS. Deposits are safeguarded under the FCS up to a maximum of $250,000 per account holder per ADI.

The coverage of a bank account under the FCS is not affected by the account holder’s citizenship or residency status. That means any accounts from international students are eligible.

The following categories of deposit accounts are covered by the FCS:

- savings accounts

- call accounts

- term deposits

- current accounts

- cheque accounts

- debit card accounts

- transaction accounts

- personal basic accounts

- cash management accounts

- farm management deposit accounts

- pensioner deeming accounts

- mortgage offset accounts (either 100 per cent or partial offset) that are separate deposit accounts

- trustee accounts

- retirement savings accounts

Yet, the FCS does not cover the following accounts:

- accounts with funds that are not in Australian dollars

- accounts kept at overseas branches of Australian banks

- credit balances on credit card facilities or other loans

- pre-paid card facilities or similar products

- ‘nostro’ accounts and ‘vostro’ accounts of foreign corporations that carry on banking business or otherwise provide financial services in a foreign country

There are 2 ways to check your bank coverage in Australia for deposits up to $250,000:

- Using the APRA (Australian Prudential Regulation Authority) deposit checker

- Getting in touch with the bank directly

Tips to Avoid Fees (Student Edition)

Affordability is definitely the most important aspect of life abroad that every overseas student wants to achieve. So, when opening and using a bank account, you need to avoid as many fees as possible to stay financially stable.

Here are some tips to do so:

- Open a student account as it normally has no monthly fees

- Do research and compare to find the most economical option

- Avoid currency exchange countries which frequently carry additional commission and instead use logical ATMs

- Integrate with digital wallets like Apple Pay or Google Pay to minimize fees related to foreign transactions

- Read the terms and conditions carefully so you can point out if there are any hidden fees to avoid

- Find a low-fee service if you often transfer money worldwide or transfer a large amount of money or for many times a month.

- Be aware that while domestic ATM withdrawals may be free, a $5 fee applies for each overseas ATM withdrawal (overseas atm fees applies).

Managing Your Finances

Managing your finances as an international student in Australia can feel overwhelming, but with a few smart strategies, you can stay in control and make your money go further. Start by creating a budget that lists all your sources of income—such as scholarships, part-time work, or money from home—and your regular expenses, including rent, food, transportation, and tuition fees. Prioritize essential expenses and pay these first to ensure your basic needs are always covered.

To save money, limit spending on non-essential items like eating out or entertainment, and look for student discounts wherever possible. When converting foreign currency to Australian dollars, compare exchange rates from different providers and use online currency converters to get the best value. Choose money transfer services with low fees and favorable exchange rates to maximize the amount you receive.

Be cautious with credit card use, as interest rates can add up quickly if you don’t pay off your balance in full. Protect your personal and financial information to avoid scams, and always use secure banking services. Plan ahead for visa-related expenses by including them in your budget, so you’re not caught off guard.

Many universities in Australia offer financial counseling and support services for international students, helping you find student-friendly accounts and manage your money wisely. Don’t hesitate to visit banks in person to ask about special student options, or join online communities and forums to share tips and experiences with other students. By staying informed and proactive, you can build a strong financial foundation and make the most of your time in Australia.

How to Switch Accounts Later (If Needed)

It is easy to switch your bank accounts with just your phone and right at home. Follow the steps below and you can be sure that everything goes without a hitch.

Note: If you don’t plan to make many auto-transfers or direct debits, it will be beneficial to start this process on a day or period when you aren’t getting paid.

- Step 1: Look for an alternative: The first thing to do is looking for options and compare them. Keep an eye out for any exclusive deals or incentives that banks may provide to new clients.

- Step 2: Open your new bank account: After you have found the favorite one, you can now open it. You can do it online within a few minutes. We are pretty sure that you know how to deal with it already.

- Step 3: Make a list of your direct debits & auto transfers: Note all your auto transfers and direct debits before canceling your old account. These could include recurring transfers to savings accounts or other accounts, as well as payments for utilities and subscriptions.

- Step 4: Transfer your money to the new account: You can now transfer your funds to the new account. Make sure that you leave enough money in your previous account to cover any unpaid direct debits or pending transactions. This will prevent you from any missed payments or overdraft fines throughout the changeover.

- Step 5: Create new direct debits & auto transfers: Use your new account to set up direct debits & auto transfers. You can do that via the online banking system of your new bank. To prevent any interruptions, make sure that all of your recurring payments are set up appropriately.

- Step 6: Leave your old account open or close it: It can be useful to keep your old account open for a few weeks and leave some money in it so that any pending direct debits or transfers can be processed. Yet, if you choose to close it, check if all of your money has been transferred. Some banks will require you to notify them by phone or email if you wish to close it. While others allow you to do it through the app.

Conclusion

It is understandable when you feel overwhelmed when choosing where to open a bank account as an international student. However, we hope that our list of the best bank accounts for international students in Australia will help you make up your mind.

Remember that a good bank account is determined by your unique requirements and preferences. It is advisable to thoroughly examine the terms and conditions, fees and services before creating a bank account. Choosing an account that helps with saving money on fees and currency conversions can make a significant difference in your finances as an international student. Good luck with your financial plan!

FAQs

1. Do I need an Australian bank account as an international student?

You will need one if you are making or spending any money in Australia. It is easy and free to open an account. So, why not?

2. What are different types of bank accounts in Australia?

There are many types of bank accounts in Australia but the 2 common ones that most banks offer and recommend for international students are:

- Transaction accounts: The most popular kind, used for regular expenses. You can use your debit card to make purchases and take out cash from ATMs and you can deposit money into it to use anytime.

- Saving accounts: You can keep money in this account if you don’t use it frequently or need it at the moment. While not all students need to open one, it is highly recommended if you want to save money from your work income and set aside some cash for big plans.

3. Can students access banking services at the Australian post office?

Yes, some banks allow you to complete banking transactions at Australian post office locations. This can be convenient if you do not have a bank branch nearby, as you can deposit or withdraw money and manage your account at participating post offices.

4. After I graduate or finish my studies, what happens to my student account?

Banks will ask you to switch account types or they may automatically deny your access to features or benefits that are exclusively available to students. If you don’t want to maintain it as you want to go back to your country, you can have your bank account terminated.

Last updated on 22/11/2025

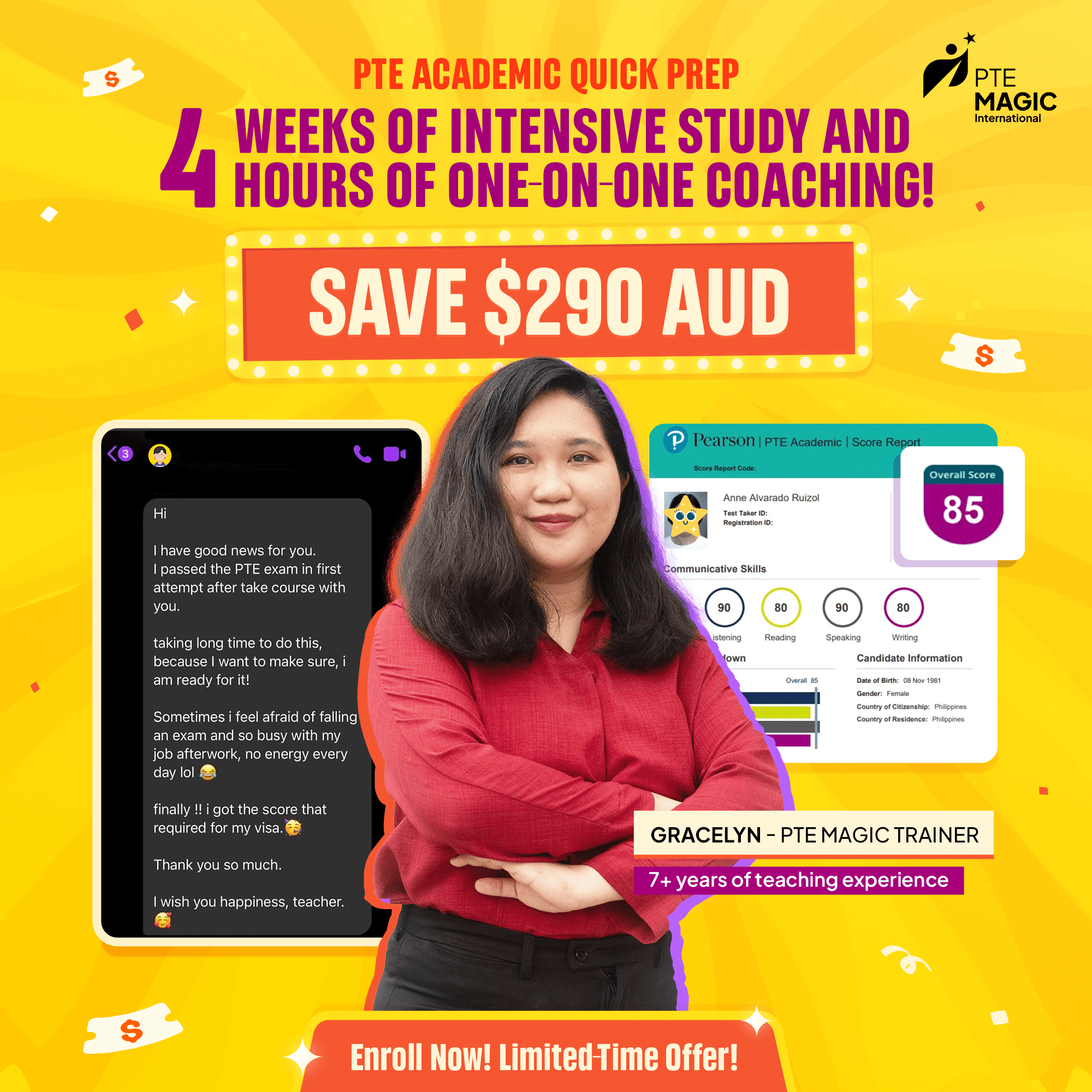

My name is Moni, and I am a seasoned PTE teacher with over 6 years of experience. I have helped thousands of students overcome their struggles and achieve their desired scores. My passion for teaching and dedication to my student’s success drives me to continually improve my teaching methods and provide the best possible support. Join me on this journey toward PTE success!

I am a firm believer that the best teachers educate with their hearts not just their minds.

Moni | PTE MAGIC International Founder

Explore PTE

Tips & Tricks

In this 2026 guide, you’ll see a complete breakdown of real living expenses, part-time job...

Read more →The cost of living in Hobart among international students is among the most important aspects...

Read more →Why Adelaide Is One Of Australia’s Most Budget-Friendly Cities Adelaide is also unique in its...

Read more →